Other Technology | July 1, 2023

At the beginning of the internet boom, there were many free services provided by companies that monetized them through advertising. Later, paid services emerged, and in the era of social networks, we have seen how user data has become a currency for many companies. Companies like Facebook have faced significant fines for how they have handled that data, although not specifically for collecting it. Even in Spain, there are movements to protect user data on platforms like WhatsApp.

In the new era of the internet, the era of artificial intelligence, data holds even more value than before. In addition to being sold to companies interested in targeting users of the collecting companies, data is also used to train the new algorithms that emerge almost every day. This new reality has prompted companies in sectors that previously had not shown significant interest in user data to decide that the time has come.

The automotive industry is one of the sectors undergoing significant changes, especially with the transition from traditional to electric and connected cars. Knowing the exact location of our car at all times is a great advantage, as well as being able to control it from our mobile phones. However, it also means that much of the data generated while driving ends up in the manufacturers’ computers.

In recent years, privacy on the internet, particularly since the explosion of smartphones, has become a growing concern. Apple has even made this a distinctive element of its products, positioning the iPhone as the most private phone, as we can see in their television commercials.

In the automotive sector, similar practices to those in telecommunications a decade ago are now emerging. Detailed data about users is being collected, ranging from their driving style to their behavior and daily routes. This is easily transmitted to company servers because most modern cars come with an integrated SIM card for emergency calls and other functions, which can also be used by the company to gather other data.

Some of the collected data is understandable, such as license plate type, VIN, or GPS positioning if we have agreed to share that information to enable the emergency assistance system. However, other data is much more personal, such as acceleration, speed, driving and braking patterns, etc.

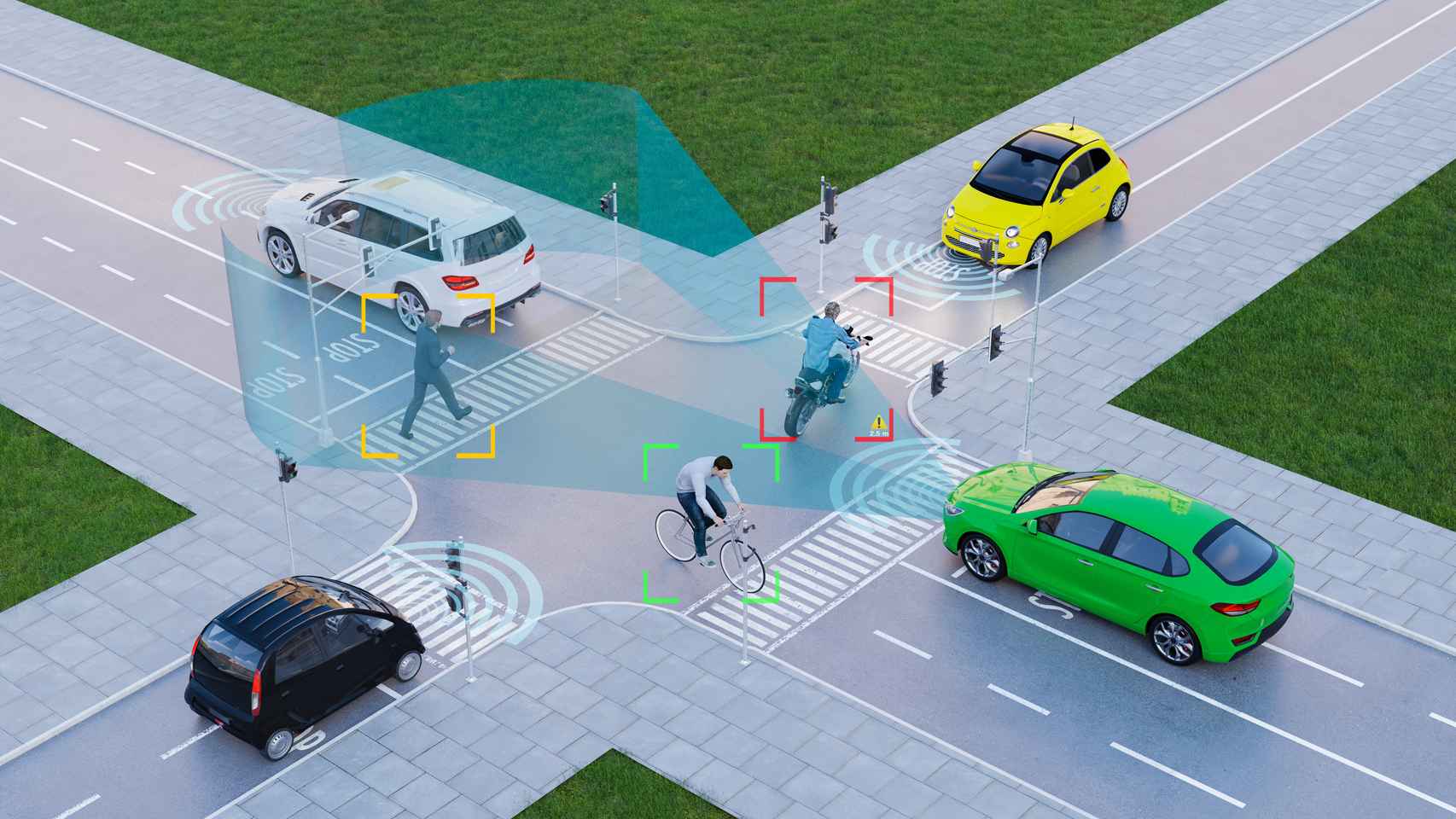

All this information allows manufacturers to significantly improve their future services. The most well-known case is Tesla, which has its FSD software in beta phase, allowing some of its cars to drive autonomously in certain regions of the United States. It is also known that all the sensor and camera information collected ends up on Tesla’s servers, where it is used to retrain their autonomous driving system for future improvements.

But there are simpler examples as well. The lane departure warning system in a vehicle can determine how frequently we apply pressure to the steering wheel to remind us not to let go, even if the car is driving on its own. This type of information is valuable not only for manufacturers but also for government agencies when drafting new regulations.

Car data can also be used to determine the features that future company cars should have, whether it’s better to focus on acceleration or autonomy, or the preferred recharging habits for electric cars.

These data remain in the possession of car manufacturers, who can use them to create new models, analyze their drivers’ real preferences, and develop better products. However, they can also sell the data. In certain economic sectors, data selling is the central element of some companies’ sales strategies, and although this has not yet reached the automotive sector, it could change in the future.

The most straightforward and obvious example is insurance companies. Some companies already offer incentives if you install an app on your mobile phone that monitors your driving behavior, including maximum speed, acceleration, and changes in direction, among others. These insurers believe that such data can reduce the chances of accidents for their customers and, in return, offer better insurance policies.

In the case of automotive companies, they can offer all this data to insurers on a massive scale, as they control millions of vehicles. Some car models even use facial scanning of the driver, like certain models from Toyota, to change the driving profile, with that information also stored. Other brands, like Tesla, use the driver’s mobile phone to identify different users of the same vehicle.

In the coming years, we will witness an increase in the collection of this data, greater concern from citizens about how it is used, and increased surveillance by authorities. Everything we have experienced first on the internet and later with mobile phones will inevitably arrive in the automotive industry, sooner rather than later.